Trade Without Restrictions. Your Capital. Your Strategy. Your Rules.

Upgrade Your Trading Experience

From sign-up to trade in 30 seconds

No KYC Required

$0

Commission

2000x

Leverage

0.01

Micro lot trading

20%

Stop Out

Powered By Revolution

Revolution

$0M+

Payouts So Far

0K+

Traders Worldwide

0+

Trading Platforms

Choose From The Best Trading Accounts

We offer a range of flexible and powerful forex trading account types, from beginner-friendly to institutional-grade.

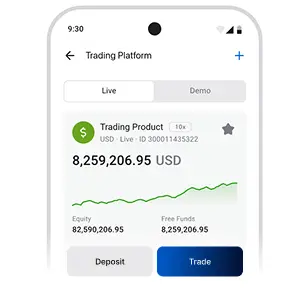

Advanced Trading Platforms

Trade on the industry's most reliable platforms: MetaTrader 4 (MT4) & MetaTrader 5 (MT5) and enjoy robust charting tools, lightning-fast executions, all with mobile compatibility.

Trusted legacy. Redefining markets.

We combine technology, education, and client-first policies into one complete trading ecosystem. Here's why traders prefer us:

Plans To Empower You

Every trader is unique, and our every plan is designed to celebrate your style and skills:

How To Get Started With Hola Prime Markets

Payment Partners

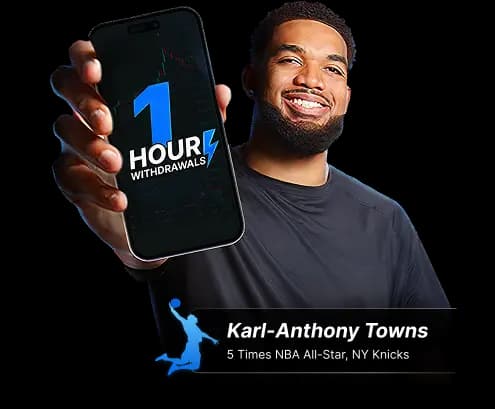

Easily withdraw your profit via global gateways - safe, fast, and flexible.

Trading Basics

Start Trading With Prime Conditions

Its free and only takes 5 minutes!