If you’ve ever watched traders talk about “ES,” “NQ,” “CL,” or “Gold futures,”

and wondered…

“What exactly are futures?

And why do so many serious traders swear by them?”

You’re about to get the cleanest, most human-friendly explanation you’ve ever read.

No jargon.

No complexity.

No textbook-level confusion.

Just real clarity.

Let’s break it down.

1. Futures Explained in the Simplest Way Possible

Futures are contracts.

That’s the whole secret.

A futures contract is a legal agreement to buy or sell something in the future

– at a price you decide right now.

The “something” can be:

- stock indices (S&P 500, Nasdaq)

- commodities (oil, gold, corn, natural gas)

- currencies

- interest rates

- bonds

When you trade futures, you’re not trading the physical product.

You’re trading the price movement of that product.

You’re basically saying:

“I think the price will go up.”

or

“I think the price will go down.”

And you profit if you’re right – simple.

2. Where Do Futures Come From?

Originally, futures existed to protect buyers and sellers from uncertainty.

Example:

A farmer growing wheat wants to know he’ll get a fair price at harvest.

A bakery wants to know wheat prices won’t skyrocket before they buy.

So they agree on a price months ahead = a futures contract.

Today?

Traders, hedge funds, banks, and prop firms use futures to trade price changes, not to exchange actual wheat or cattle.

Most contracts never result in physical delivery – they’re closed long before expiration.

3. Why Futures Matter for Everyday Traders

Here’s why pros love futures:

A. They’re extremely liquid

Some contracts trade hundreds of thousands of contracts per day.

Smooth fills.

Tight spreads.

Clean price action.

B. You can trade long AND short easily

There’s no special process for shorting.

You just click “Sell.”

C. Low capital, high leverage

You don’t need $100,000 to trade the S&P 500.

You can trade a micro futures contract with a small account.

D. No pattern day-trading rule

Unlike stocks, futures don’t punish active traders.

E. You trade almost 24 hours a day

From Sunday evening to Friday afternoon.

This flexibility is a HUGE advantage.

4. How Futures Trading Actually Works

Let’s break down a real futures trade example.

Step 1: Choose Your Market

Say you want to trade the S&P 500.

You pick:

- ES = full-sized S&P futures

- MES = micro S&P futures

Same chart.

Same movement.

Different contract size.

Step 2: Choose direction

You Buy if you think price will rise.

You Sell if you think price will fall.

Step 3: Price moves

Each futures contract has a tick value.

Example:

- MES = $1.25 per tick

- NQ = $5 per tick

- CL = $10 per tick

So if the price moves 10 ticks in your favor:

- MES gives you $12.50

- NQ gives you $50

- CL gives you $100

Step 4: You close the contract

You exit by doing the opposite action:

- If you bought → you sell to close

- If you sold → you buy to close

Boom.

Trade done.

No shares.

No assets.

Just price movement.

5. What Makes Futures Different from Stocks or Forex?

A. Futures have built-in leverage

You control a large contract with a small amount of capital.

B. They’re regulated by CME (Chicago Mercantile Exchange)

This offers:

- transparency

- no hidden manipulation

- predictable rules

- fair fills

C. Futures don’t have overnight rollover or swap fees

Forex traders pay swaps.

Stock traders deal with margin interest.

Futures traders don’t.

D. Futures are standardized

Every contract has:

- the same tick size

- the same value

- the same expiration

- the same rules

No surprises.

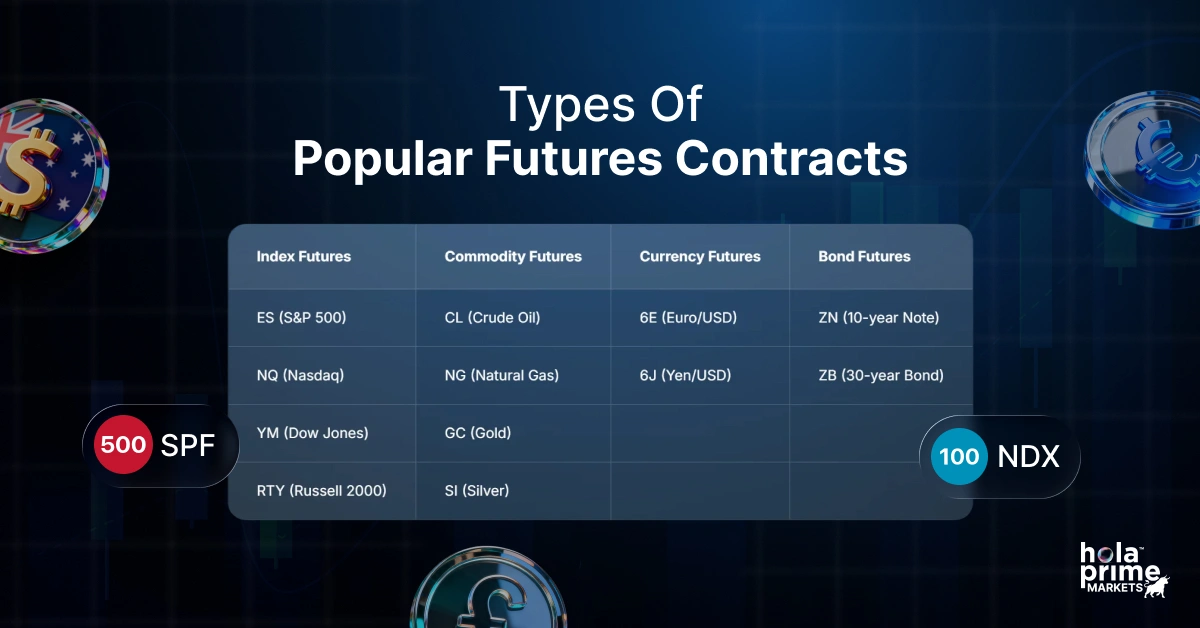

6. Types of Popular Futures Contracts (What Traders Actually Trade)

Index Futures:

- ES (S&P 500)

- NQ (Nasdaq)

- YM (Dow Jones)

- RTY (Russell 2000)

These are the most popular for day trading.

Commodity Futures:

- CL (Crude Oil)

- NG (Natural Gas)

- GC (Gold)

- SI (Silver)

Commodity futures move FAST – high volatility, high opportunity.

Currency Futures:

- 6E (Euro/USD)

- 6J (Yen/USD)

A futures alternative to Forex pairs.

Bond Futures:

- ZN (10-year Note)

- ZB (30-year Bond)

Popular with macro traders.

7. Futures Expiration & Rollovers

Every futures contract has an expiration month.

But don’t worry –

you almost NEVER hold until expiration.

You just “roll” to the next contract when volume shifts.

For example:

- ES December → ES March

- CL January → CL February

Your broker or platform usually tells you when to roll.

8. Who Should Trade Futures?

Futures are ideal for:

- day traders

- swing traders

- prop firm traders

- traders with small capital

- strategy-based traders

- algorithmic traders

If you like clean charts, fair fills, and real volatility,

futures are a dream.

If you hate:

- manipulation

- low liquidity

- fakeouts

- broker games

- Commissions eating your profits

then futures are even better.

9. The Risks Traders Don’t Talk About

Let’s keep it real:

Futures have leverage –

and leverage can cut both ways.

Risks include:

- margin calls

- slippage during news

- fast price movements

- blowing accounts quickly without discipline

Futures reward discipline

and punish impulse.

But if you manage risk well,

they’re one of the most powerful instruments a trader can use.

The Simple Summary: What Are Futures & Why Do They Matter?

Here’s the cleanest answer:

Futures are standardized contracts that let you trade price movements of major markets using leverage – without owning the underlying asset.

They work because:

- you’re trading the contract

- not the physical product

- with transparent rules

- in a highly liquid environment

- with nearly 24-hour access

- and clean long/short flexibility

That’s why professional traders

and prop traders

love futures.

They’re efficient.

They’re powerful.

They’re fair.

And they’re built for serious traders.