Introduction

1. Let’s Start With the Basics: What Exactly Is Forex?

If you’ve ever traveled abroad and exchanged your money for another currency, congratulations – you’ve already dipped your toes into forex trading.

But, in the real forex market, people aren’t just swapping cash for vacations. They’re buying and selling currencies hoping to profit from price changes. It’s fast, dynamic, and happens 24 hours a day, five days a week.

Forex, short for foreign exchange, is the largest financial market in the world, with more than $7 trillion traded daily. Yep, that’s trillion, with a “T.”

And at the heart of all this action are currency pairs – the building blocks of forex trading.

Now, not all pairs are equal. Some are super active, with tons of traders and tight spreads. Others move slowly or unpredictably, offering higher risks (and sometimes higher rewards). These are grouped into major, minor, and exotic pairs, and that’s exactly what we’re about to explore.

2. Currency Pairs

Every forex trade involves two currencies – one you buy, and one you sell. That’s why they’re called pairs.

Take EUR/USD, for example. The first part (EUR) is the base currency, and the second (USD) is the quote currency. If the EUR/USD price is 1.10, it simply means 1 Euro equals 1.10 US Dollars.

So when you buy EUR/USD, you’re betting that the Euro will rise against the Dollar. If it does, you make money. If it falls, you lose.

Simple? Pretty much. But here’s the kicker – every pair behaves differently. Some pairs move smoothly, others whip around like rollercoasters.

That’s where understanding major, minor, and exotic pairs really helps. Once you know what type of pair you’re dealing with, you can match it with your trading style – whether you prefer slow and steady moves or high-volatility action.

3. Why Liquidity Matters

Imagine trying to sell your old iPhone. In a big city, it’s gone within hours. But in a tiny town, you might wait weeks for a buyer.

That’s liquidity – how easy it is to buy or sell something without changing its price too much.

The same logic applies to forex pairs:

- Major pairs are traded constantly, meaning there’s always someone willing to buy or sell. They’re super liquid.

- Minor pairs are fairly active but don’t have as much daily volume.

- Exotic pairs? They’re like selling that iPhone in a small town. Not impossible, but slower – and often more expensive.

When a pair is liquid, you can open and close trades quickly and pay smaller spreads (the cost between the buy and sell price). That’s why beginners usually start with major pairs – they’re smoother, cheaper, and less unpredictable.

4. Major Currency Pairs

Let’s talk about the celebrities of the forex world – the major pairs. These are the most traded, most stable, and most talked-about pairs out there.

What makes a pair “major”? It must include the US Dollar (USD) – the most powerful and widely used currency in global trade.

Here are the top seven majors:

- EUR/USD – Euro vs US Dollar

- USD/JPY – US Dollar vs Japanese Yen

- GBP/USD – British Pound vs US Dollar

- USD/CHF – US Dollar vs Swiss Franc

- AUD/USD – Australian Dollar vs US Dollar

- USD/CAD – US Dollar vs Canadian Dollar

- NZD/USD – New Zealand Dollar vs US Dollar

These pairs alone account for about 80% of all forex trades worldwide.

Why do traders love them?

- Tight spreads (lower costs)

- Massive liquidity (easy entry and exit)

- Tons of market data and analysis available

- Predictable movements based on major global events

For anyone starting out, major pairs are the ideal training ground. They help you understand how global economics, politics, and even news headlines move the market – without the wild price swings that come with exotics.

5. Minor Pairs

If majors are Hollywood stars, minor pairs are like indie favorites – not as famous, but still very interesting to watch.

Minor pairs are any combinations that don’t include the US Dollar. For example:

- EUR/GBP (Euro vs Pound)

- AUD/JPY (Australian Dollar vs Japanese Yen)

- EUR/CHF (Euro vs Swiss Franc)

They’re called cross pairs because they “cross” two major currencies without the USD in between.

Minors usually have:

- Slightly wider spreads than majors

- Moderate liquidity

- Great opportunities for traders who understand regional economies

These pairs tend to move based on European or Asian market hours, so timing your trades becomes more important.

If you’re a bit more experienced and like analyzing country-specific trends – say, how Brexit affected GBP or how Japan’s policies impact the Yen – minors can be a great playground.

6. Exotic Currency Pairs

If major pairs are smooth highways and minor pairs are scenic backroads, exotic pairs are the dirt trails – thrilling, unpredictable, and not for everyone.

Exotic pairs combine a major currency (like the USD or EUR) with a currency from a developing or smaller economy – think of the Turkish lira (TRY), South African rand (ZAR), or Thai baht (THB).

Some examples include:

- USD/TRY (US Dollar vs Turkish Lira)

- EUR/SGD (Euro vs Singapore Dollar)

- USD/ZAR (US Dollar vs South African Rand)

These pairs move differently – often more sharply – because they’re affected by things like political instability, low liquidity, and sudden economic news.

Now, exotic doesn’t mean bad. It just means less predictable.

If you’re an experienced trader who enjoys volatility and knows how to manage risk, exotics can offer exciting opportunities.

But for beginners? It’s better to watch them first and understand their behavior before jumping in.

Think of them as spicy food – start mild before going full ghost pepper.

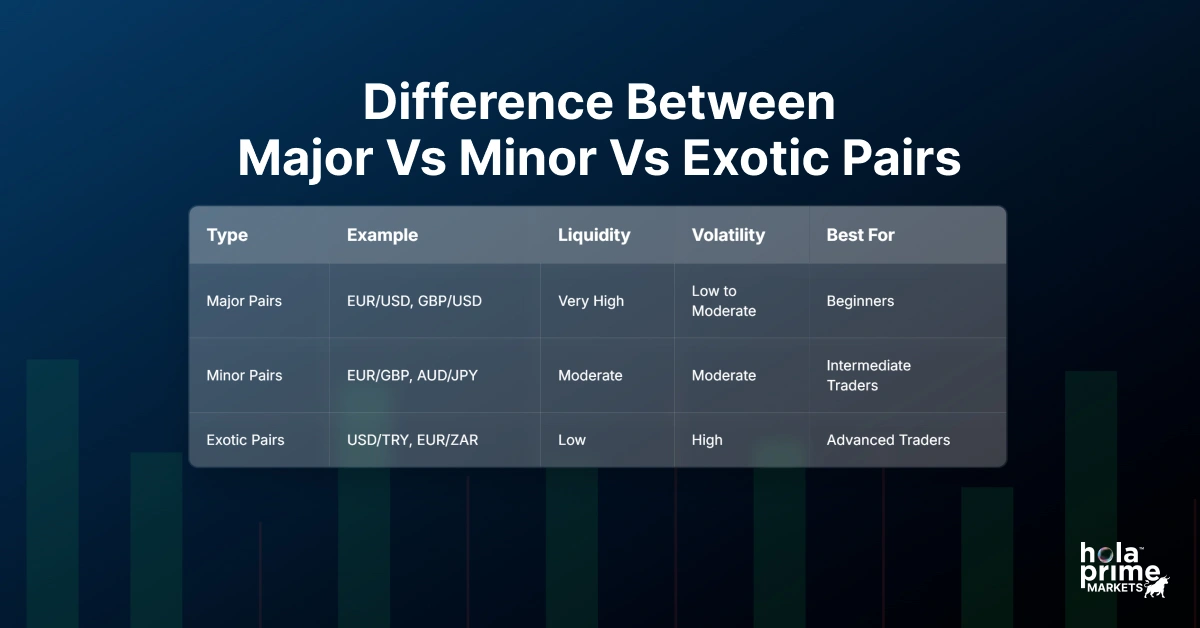

7. Major vs Minor vs Exotic Pairs: What’s the Real Difference?

Let’s break it down in plain language.

Major pairs are calm and reliable – like blue-chip stocks.

Minor pairs move a bit faster and can give more room for analysis.

Exotic pairs? They’re wildcards – higher risk, but potentially higher reward.

Your choice depends on your trading personality.

If you like steady progress and clear trends, stick with majors.

If you love analyzing international dynamics, a minor might suit you better.

And if you enjoy adrenaline and have solid risk control, exotics can be your playground.

8. How to Choose Which Pairs to Trade

Picking the right pair is a bit like dating – compatibility matters.

Just because a pair looks attractive on the chart doesn’t mean it’s the right fit for you.

Here are a few things to think about before choosing:

- Volatility: How much does the pair move daily? If you’re new, less is more.

- Liquidity: Can you enter and exit trades easily without paying high spreads?

- News Sensitivity: Some currencies react strongly to political or economic events.

- Trading Hours: Does the pair move more during your active trading hours?

For example, if you’re in Canada and trade during North American hours, USD/CAD or EUR/USD make sense.

But if you’re trading at night or during Asian sessions, AUD/JPY or NZD/USD could fit better.

At the end of the day, the best currency pair is the one that fits your lifestyle, your schedule, and your risk comfort zone.

9. Volatility – The Double-Edged Sword

Volatility is like caffeine – a little bit wakes you up, too much makes your hands shake.

In forex, volatility means how much a pair’s price moves within a certain time.

- Major pairs like EUR/USD usually move steadily.

- Exotic pairs like USD/ZAR can jump dramatically within minutes.

Traders love volatility because it creates opportunity. But without discipline, it can quickly turn profits into losses.

A smart approach is to understand how volatile your chosen pair usually is. You can use tools like Average True Range (ATR) or look at historical charts to gauge the movement.

Remember, you don’t have to chase volatility to make money – you just have to understand it.

10. Economic Indicators

Currencies don’t move randomly. Behind every price change, there’s an economic story unfolding.

Here are the key players that move currency pairs:

- Interest Rates: When a country raises rates, its currency often strengthens because investors want better returns.

- Inflation: High inflation weakens a currency’s value over time.

- GDP Growth: A strong economy attracts investors, pushing the currency higher.

- Employment Data: When more people have jobs, consumer spending goes up – boosting the currency.

For example:

When the U.S. Federal Reserve hints at raising interest rates, USD pairs often surge.

When the Bank of Japan maintains ultra-low rates, the JPY tends to weaken.

Understanding these factors helps you make sense of why a currency is moving – instead of feeling like you’re guessing in the dark.

11. Timing the Market – When to Trade Which Pair

Timing is everything in forex.

Each region’s market opens and closes at different times and currencies tend to be most active when their home markets are awake.

Here’s a simple breakdown:

Major pairs like EUR/USD are most active during the London–New York overlap – when both markets are open.

Minor pairs like AUD/JPY move more during Asian hours.

Exotic pairs often have unpredictable liquidity outside their local market times, which can lead to sudden spikes or slippage.

If you’re a beginner, trade when liquidity is high and spreads are tight – usually during the overlaps.

12. Correlations

Currencies don’t move in isolation. Many pairs are connected – what happens to one often affects another.

For instance:

- EUR/USD and GBP/USD usually move in the same direction because both are traded against the USD.

- USD/JPY and Gold (XAU/USD) often move in opposite directions because gold is a safe-haven asset.

Knowing these relationships helps you avoid doubling your risk unknowingly.

For example, if you open long trades on both EUR/USD and GBP/USD, you’re essentially betting twice against the dollar.

Smart traders use correlation matrices or observation to plan balanced trades and reduce overexposure.

13. Managing Risk Across Pair Types

No matter how confident you feel, never forget this: risk management is the real superpower of a trader.

Trading majors may feel safe, but one unexpected news release can still shake prices.

Trading exotics may seem lucrative, but a sudden policy change can flip your trade upside down.

A few golden rules to remember:

- Always set stop-loss and take-profit levels.

- Don’t risk more than 1–2% of your capital on a single trade.

- Diversify – mix a few majors with one or two minors instead of going all-in on exotics.

The goal isn’t to avoid losses altogether – it’s to make sure your losses are small enough to stay in the game long-term.

14. The Psychology Behind Pair Selection

Some traders are calm and calculated. They like watching charts move slowly, waiting patiently for setups. Those people usually stick with major pairs – steady, predictable, not too wild.

Then there are the adrenaline junkies. They want action. They love watching charts spike, retrace, and spike again. They’ll often wander toward exotic pairs, where anything can happen in a heartbeat.

Neither is wrong. What matters is knowing which one you are.

Once you pick pairs that match your temperament, everything changes. Trading starts feeling natural – not forced. You stop trying to fit into a system that doesn’t suit you.

15. Common Mistakes Beginners Make

We’ve all been there – staring at charts at 2 a.m., chasing setups that “look good.” But most early mistakes come down to a few repeat offenders.

- Jumping straight into exotic pairs.

They look exciting, right? Big moves, huge profits. But also huge losses. Exotic pairs can chew through your account before you even understand what happened. - Ignoring spreads.

Spreads are like silent taxes. You barely notice them – until you realize how much they’ve eaten into your gains. Majors usually have tight spreads. Exotics? Not so much. - Trading at dead hours.

Ever placed a trade that instantly goes wrong? You probably traded during low liquidity. Stick to major sessions when the market’s alive. - Skipping the homework.

Every currency tells a story. The more you know about the countries behind them, the less likely you are to get blindsided.

Trading isn’t about being perfect. It’s about learning from mistakes fast – before they start costing real money.

16. Tools That Make Pair Analysis Easier

You don’t need 20 fancy indicators to trade well. You just need a few reliable tools and the discipline to use them.

Here’s what helps most:

- Economic calendars – so you don’t get caught off guard by big announcements.

- Charting platforms like TradingView or MetaTrader – to spot patterns and see the bigger picture.

- Correlation trackers – to check if your pairs are moving together or against each other.

- Volatility indicators – so you know when to expect turbulence.

Most platforms, including Hola Prime, have these built right in. Once you learn how to read them properly, trading stops feeling like a guessing game.

17. Technical Analysis

Charts aren’t just lines and candles – they’re emotions. Fear, greed, hesitation… all playing out in real time.

When you see higher highs and higher lows, the market’s confident.

When it starts moving sideways, it’s indecisive.

And when you see sudden spikes and drops, that’s emotion taking over – panic buyers and sellers rushing in.

Majors usually move gracefully. Minors are a bit jumpy. Exotics? They throw tantrums.

Don’t just rely on indicators – learn to read the flow. Watch how candles react near key levels. Notice how volume picks up before a breakout. Once you tune into that rhythm, trading feels less mechanical and more instinctive.

18. Fundamental Analysis

Every candle on your chart tells a story – an economy growing, a government shifting policy, a central bank reacting to pressure.

For instance:

- When U.S. job data comes out strong, the dollar often jumps.

- When oil prices crash, the Canadian dollar tends to dip – because oil drives a big chunk of their economy.

Once you understand these relationships, trading gets deeper. You stop reacting and start anticipating.

You’re no longer just trading “EUR/USD.”

You’re trading the confidence of Europe versus the strength of America.

That’s the kind of awareness that separates the gamblers from the pros.

19. How Geopolitics Shapes the Market

One political headline – that’s all it takes for markets to flip.

Remember Brexit? The pound went on a wild ride for months.

Or when trade tensions heat up between the U.S. and China, the yen suddenly strengthens because traders rush to safety.

Exotic currencies get hit even harder. A minor election, a policy shift, or even a rumor can cause a massive price swing.

The lesson? Always keep an eye on global events. Even if it’s not your trading pair, it can ripple through the market.

20. Building a Balanced Forex Portfolio

Think of your trading pairs like a diet – too much spice, and you’ll burn out.

Mix it up:

- Majors for consistency

- Minors for opportunity

- Exotics for excitement

That balance keeps your equity curve healthy. If one pair’s behaving badly, another might keep you afloat.

A smart trader doesn’t just chase volatility – they build balance.

21. Advanced Pair Selection Strategies

Once you’ve got a feel for the basics, it’s time to level up.

- Carry trades: Borrow in a low-interest currency and invest in a high-yield one. Works beautifully when the market’s calm.

- Scalping majors: Perfect for traders who like fast-paced action with low spreads.

- Swing trading: Best for those who prefer holding positions for days and catching the bigger waves.

Find what matches your rhythm. The “best” strategy isn’t what works for others – it’s the one that feels natural to you.

23. The Human Side of Trading

No one talks enough about this part.

Trading isn’t just about charts. It’s about you – your emotions, your patience, your ability to stay calm when everything feels upside down.

You’ll feel overconfident one day and terrified the next. You’ll question yourself. You’ll even want to quit.

But if you learn to stay centered – to breathe, step back, and think clearly – you’ll last longer than most. The market rewards discipline, not drama.

24. Why Hola Prime Feels Different

If you’ve traded for a while, you’ve probably seen brokers with hidden rules and delayed payouts. It’s frustrating.

That’s why Hola Prime built its foundation on transparency.

You get weekly trade logs, instant payouts, and 24/5 real human support. No shady terms, no surprise conditions.

They even share trade execution reports – so you know exactly how your trades are being handled.

It’s a platform that actually wants you to succeed and that’s rare.

25. Wrapping It Up

Understanding major, minor, and exotic pairs isn’t just a technical thing – it’s a personal journey.

Majors will teach you patience.

Minors will teach you adaptability.

Exotics will teach you respect for volatility.

Trading isn’t about outsmarting the market — it’s about syncing with it. Once you find that flow, everything starts clicking.

And if you want a platform that moves with that same honesty and rhythm, Hola Prime is a solid place to start.