A Simpler Way to Trade Bitcoin Without Becoming a Crypto Hoarder

Trading Bitcoin can feel intimidating if you’re not a “crypto person.”

Maybe you don’t want to set up a wallet, manage keys, or worry about hackers who seem to have more free time than you do.

Yet the price keeps moving – up, down, up again – and you might be thinking:

“There’s gotta be a way to profit from this without becoming a full-time blockchain engineer.”

Guess what? There is.

It’s called Bitcoin CFD Trading – and you don’t need to own even a single satoshi.

Let’s break it down like normal people, not like a crypto manual trying to sound smart.

1. What Are Bitcoin CFDs?

CFD stands for Contract for Difference, but don’t let the name scare you.

A CFD is simply an agreement between you and a broker that says:

“If Bitcoin’s price moves, one of us will make money from the difference.”

You are not collecting real Bitcoin.

You’re not mining it in your basement.

You’re not guarding a private key like it’s the last cookie in the jar.

You’re simply trading the price movement.

If Bitcoin goes up and you predicted correctly, you profit.

If it goes down and you predicted that, you profit too.

You’re basically saying:

“Let’s bet on where Bitcoin’s price is heading.”

Except instead of a casual bet with a friend, you do it through a regulated trading platform.

2. Why Trade Bitcoin CFDs Instead of Buying Real Bitcoin?

Here’s the truth: a lot of Bitcoin holders aren’t investors – they’re accidental collectors.

They bought some, forgot about it, and now panic every time the price drops.

CFDs give you a different experience. You can:

- Trade both up and down markets

- Use leverage to control bigger positions

- Skip crypto wallets, exchanges, and storage risks

- Withdraw profits in regular money (USD, EUR, etc.)

Think of it as Bitcoin exposure without the crypto lifestyle.

3. Can You Really Make Money Trading Bitcoin Without Owning It?

Yes – but not by guessing.

CFD traders make money the same way successful traders in any market do:

- By reading price movements

- By managing risk

- By not letting greed make decisions

You don’t need to marry Bitcoin.

You just trade its ups and downs like you would with gold, oil, or stocks.

If you’re wondering how to make money trading Bitcoins without buying them, the secret isn’t holding – it’s timing and strategy.

4. Long or Short: Two Simple Ways to Trade Bitcoin CFDs

Trading Bitcoin CFDs really boils down to two choices:

-

Going Long (Buy)

You buy the CFD if you think Bitcoin will rise. If it goes up – you profit.

-

Going Short (Sell)

You sell the CFD if you think Bitcoin will fall. If it drops – you profit.

Simple.

You’re not a “bear” or a “bull.”

You’re just making smart moves based on direction.

That flexibility is something traditional Bitcoin holders never get.

They can only hope it goes up. You can profit even when it crashes.

5. Do You Need a Crypto Wallet for CFD Trading?

Nope.

No wallet.

No blockchain confirmations.

No fear of losing your coins to a wrong wallet address that looks like a Wi-Fi password.

CFDs sit on a broker platform, not in a crypto exchange that might crash, get hacked, or freeze withdrawals like a stubborn ATM.

All you need is a trading platform, a chart, and a plan.

Life just got simpler.

6. Leverage in Bitcoin CFDs

One of the biggest reasons traders pick CFDs over actual Bitcoin is something called leverage.

Sounds fancy, but it just means you can control a bigger trade with a smaller amount of money.

Think of leverage like driving a sports car.

It’s thrilling… until you hit the accelerator too hard.

Example in plain English:

Let’s say you have $200. With leverage, you might control a $2,000 Bitcoin trade.

If the price moves in your favor – great.

You profit on the $2,000 value, not just your $200.

If the price moves against you – not so great.

Losses are also based on $2,000, not your $200.

That’s why leverage must be handled like hot coffee:

Nice to have… but don’t spill it on yourself.

7. Risk Management

CFD trading isn’t gambling. It’s calculated decision-making with safety tools.

Those safety tools are risk management and without them, even brilliant predictions can turn into disasters.

The three things every Bitcoin CFD trader needs:

-

Stop-Loss Orders

This automatically exits your trade if it starts to go too far in the wrong direction.

Think of it as an emotional brake when your brain tries to convince you to “just hold a bit longer.”

-

Take-Profit Orders

This locks in your profits before greed convinces you to “wait for more.”

Yes, greed ruins more traders than bad charts ever will.

-

Position Sizing

Don’t trade too big.

Start with small bites, not oversized chunks of bitcoin price movement.

Smart CFD traders don’t just focus on how to trade Bitcoin –

they focus on how not to blow up while doing it.

8. Popular Strategies for Trading Bitcoin CFDs (Simple & Practical)

You don’t need a PhD in chart analysis to trade smart.

Let’s keep it simple and realistic with strategies real traders actually use.

Trend Following

If Bitcoin is trending upward, you go long.

If it’s trending downward, you go short.

You’re not trying to predict – you’re just going with the flow.

Like surfing:

You don’t argue with the wave.

You ride the direction it’s already moving.

Breakout Trading

You wait for Bitcoin to break out of a key level – like smashing through a door.

If it breaks up, you buy.

If it breaks down, you sell.

Good things happen when you stop guessing and let price show you the way.

Scalping

This is for fast-thinkers. You take small profits from quick moves.

It’s not glamorous, but small wins stacked together can beat one risky big trade.

Scalping is like snacking – you don’t need a giant meal to feel satisfied.

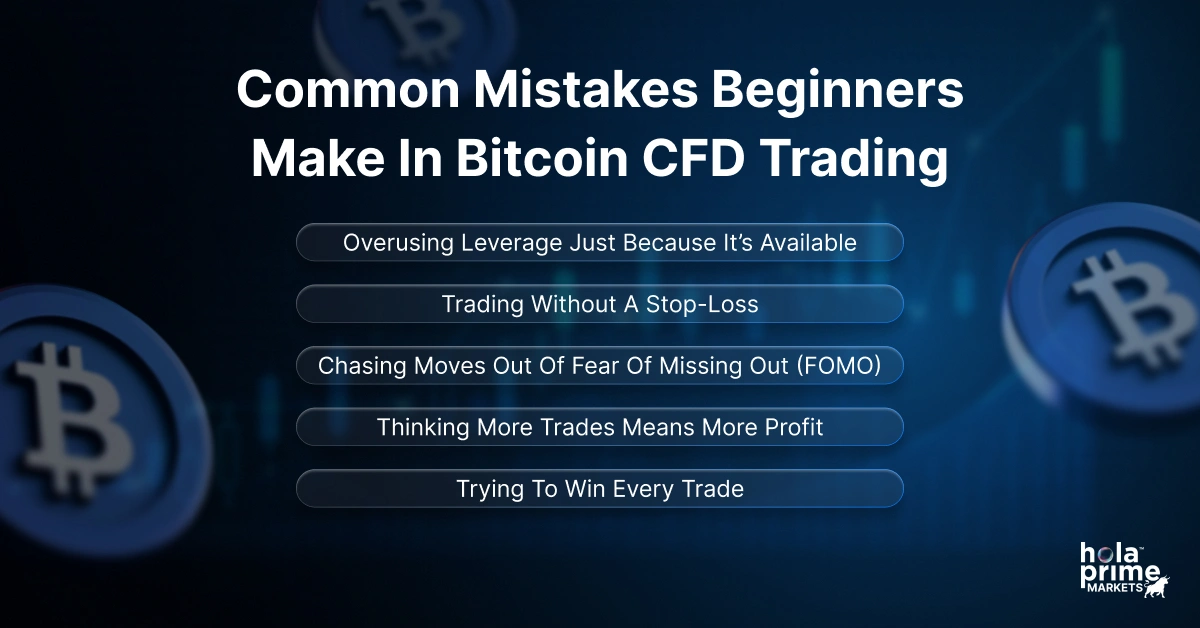

9. Common Mistakes Beginners Make in Bitcoin CFD Trading

CFD trading isn’t hard…

but the mistakes are easy.

Here are the big ones to avoid:

-

Overusing leverage just because it’s available

It’s tempting. Don’t do it.

-

Trading without a stop-loss

That’s like driving downhill with no brakes.

-

Chasing moves out of fear of missing out (FOMO)

Bitcoin moves a lot. Another opportunity will always come.

-

Thinking more trades means more profit

Quality beats quantity – especially in volatile markets.

-

Trying to win every trade

Even great traders lose trades.

The goal isn’t perfection – it’s smart survival.

10. Conclusion: Trade Bitcoin Without Becoming a Crypto Collector

Trading Bitcoin via CFDs is freedom.

You can profit without owning the asset, without worrying about wallets, hackers, or whether your exchange CEO runs away to a tropical island.

CFDs let you trade the price, not the coin.

You can:

- trade both up and down trends

- use leverage (responsibly!)

- follow smart strategies

- protect yourself with risk tools

- withdraw profits in normal currency

You don’t need to become a Bitcoin evangelist.

You don’t need to argue about block sizes or hold coins for years waiting for “the moon.”

You just trade the movement – like any other market.