If you’ve ever dipped your toes into gold trading, you’ve probably heard the terms “gold futures” and “spot gold.”

At first, they sound almost identical – it’s all about gold, right? But dig a little deeper, and you’ll find they play by very different rules.

One deals with the price of gold right now, the other with what people think it’ll be worth later.

Both are powerful tools – but understanding how they differ can make or break your trading decisions.

Let’s unpack that, slowly and clearly.

1. What Exactly Is Spot Gold?

When people talk about the “gold price” on the news or on a trading app, they’re usually talking about spot gold.

That’s the live, real-time price of gold at that very moment – what buyers and sellers agree it’s worth right now.

So, if gold is quoted at $2,350 per ounce, that’s the spot price – the amount you’d pay if you wanted to buy gold for immediate delivery.

Think of spot gold as the “cash market.” No contracts, no waiting, no expiry dates. Just gold – priced in the moment.

Even though most retail traders never physically receive the gold (your broker handles it virtually), spot prices represent the heartbeat of the entire gold market.

Everything else – futures, ETFs, and even jewelry prices – moves in relation to that spot value.

2. So, What Are Gold Futures Then?

Now, this is where things shift gears.

Gold futures aren’t about owning gold right now – they’re about agreeing on a price today for gold that’ll be delivered later.

Let’s say you buy a June 2025 gold futures contract at $2,400 per ounce.

That means you’re locking in today’s price, expecting the market to rise in the coming months.

If it does – say gold hits $2,460 – you could close the contract and pocket the profit, without ever touching a single gold bar.

That’s the beauty (and risk) of futures:

You’re trading expectations and contracts, not the actual metal.

And since these contracts are traded on major exchanges like COMEX or ICE, they follow strict margin and leverage rules – attracting both speculators and large institutions.

In short, spot gold is “now,” and futures are “later.”

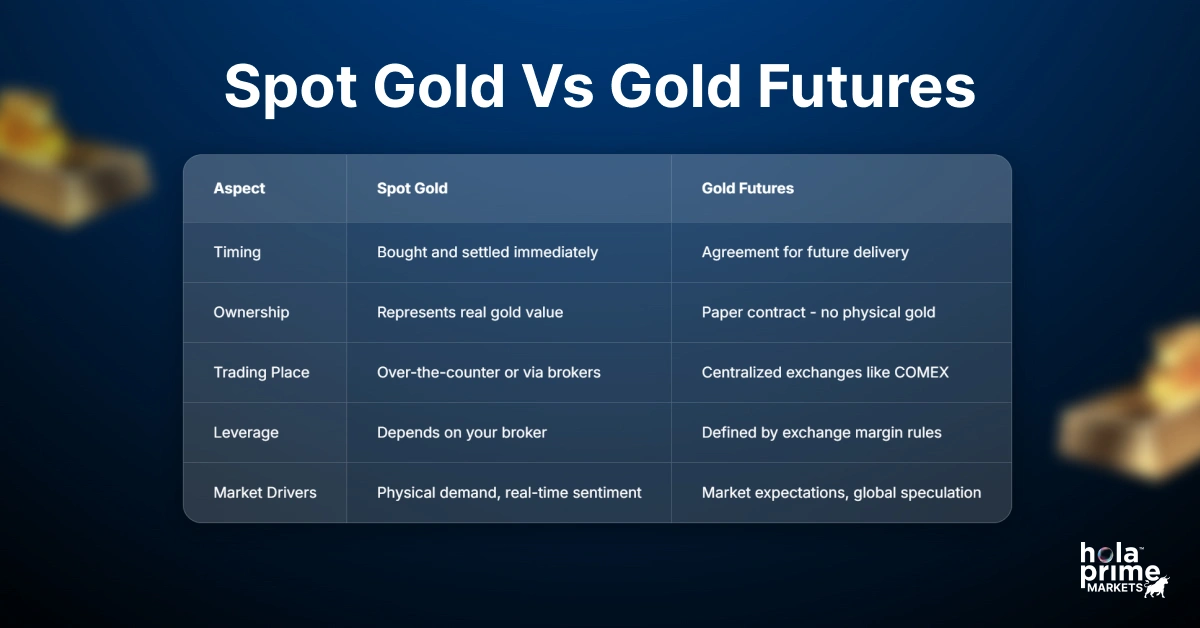

3. Spot Gold vs Gold Futures – The Core Differences

Here’s where the two start to drift apart:

So, the difference between spot gold and gold futures is basically time, intent, and purpose.

Spot gold is all about what’s happening right now.

Futures are about what people think will happen next.

If gold were a movie, spot gold would be the live broadcast, and gold futures would be the trailer predicting what’s coming.

4. Why the Prices Don’t Match (and That’s Okay)

Here’s something that confuses almost every new trader:

Why isn’t the gold futures price the same as the spot price?

If spot gold is $2,350 and the futures contract is $2,370 – what’s going on?

The answer lies in a few subtle details:

- Storage & Insurance Costs – Keeping physical gold safe isn’t free. Those costs often get baked into the futures price.

- Interest Rates – When rates go up, holding gold becomes less attractive (since it doesn’t pay interest). That can make futures prices dip below spot.

- Market Expectations – If traders believe gold will rise, futures prices naturally trade at a premium.

This difference is often called the “futures premium,” and it changes with time, rates, and sentiment.

As the contract gets closer to expiry, the futures price usually moves closer to the spot price – a process known as convergence.

5. Who Trades What and Why

Not every trader uses both markets. Each one attracts a different kind of crowd.

Spot gold traders are usually:

- Retail traders chasing short-term price swings

- CFD traders looking for quick profits

- Jewelers and refiners following live physical prices

Gold futures traders, on the other hand, are typically:

- Institutional players (hedge funds, central banks, etc.)

- Professional speculators

- Companies hedging their exposure to gold prices

If you prefer flexibility, simplicity, and direct exposure, spot gold is your playground.

If you’re more into structured trading, leverage, and hedging, futures might feel more like home.

6. How They Move and Why It Matters

Spot gold moves with immediate market sentiment.

Inflation news? Central bank announcement? A sudden geopolitical event?

You’ll see it instantly reflected in the spot price.

Futures, meanwhile, often react to what traders think those events will mean down the line.

It’s a layer of speculation built on top of the present.

That’s why sometimes futures prices shift before the spot market even blinks – traders are already betting on tomorrow’s headlines.

But as each futures contract nears expiry, the two eventually meet again – future meets present, and prices realign.

7. The Appeal of Spot Gold – Why Many Traders Love It

There’s something beautifully simple about spot gold.

You see the price, you buy or sell, and that’s it. No expiry dates, no margin calls tied to contract months – just pure exposure to gold’s current value.

That’s why many short-term traders, especially in the retail crowd, gravitate toward it.

Here’s why spot gold feels so approachable:

- Real-time trading – You’re reacting directly to live market sentiment, not speculating on what might happen months from now.

- Easy access – Most brokers offer spot gold or gold CFDs with user-friendly platforms. You can trade from your phone in seconds.

- No expiry pressure – You don’t have to worry about rolling contracts or watching them expire worthless.

- Lower capital barrier – You don’t need massive accounts or institutional connections to get started.

It’s straightforward. You can open a trade when you expect movement, close it when you’ve had enough, and be done.

Spot gold is like that friend who tells you exactly what’s going on right now – no filters, no forecasts, just the raw truth of the market.

8. Why Some Traders Prefer Gold Futures

On the other hand, gold futures attract a different type of trader – the ones who enjoy structure, scale, and the thrill of precision.

With futures, you’re not just trading – you’re operating within one of the most transparent, regulated markets in the world.

Here’s what draws traders toward gold futures:

- High liquidity – Futures markets are deep and active, especially for contracts like COMEX Gold (GC). You can enter and exit with minimal slippage.

- Standardization – Each contract represents a fixed amount of gold (usually 100 troy ounces), traded under set rules.

- Leverage – Futures allow you to control large positions with relatively small margins – a double-edged sword but powerful when used wisely.

- Hedging potential – Futures let miners, funds, and large investors protect themselves against price swings months in advance.

Unlike spot gold, futures trading feels more like playing chess than checkers – you’re thinking a few moves ahead, planning around upcoming expiries, interest rates, and market psychology.

It’s not for everyone, but for those who like the structure and sophistication, gold futures offer a level of control spot gold simply can’t match.

9. Understanding the Gold Futures Spot Price Connection

Even though spot gold and futures trade differently, they’re not living separate lives.

Think of the spot price as the anchor – the baseline reality.

Futures prices float around that anchor, pulled higher or lower depending on expectations, costs, and market conditions.

When traders talk about the gold futures spot price, they’re basically comparing today’s live gold value with what the futures market thinks it’ll be worth.

Here’s what typically shapes that relationship:

- Time value – The further away the delivery date, the more uncertainty, and that can make futures prices drift away from spot.

- Carrying costs – Storage, insurance, and financing get built into the future price.

- Market mood – Bullish traders push futures up; bearish ones drag it down.

But as expiry gets closer, those differences fade.

Eventually, the futures price converges with the spot price, because by delivery day, “future” becomes “now.

It’s a fascinating dance between perception and reality, and smart traders watch both closely.

10. The Role of Leverage – Blessing or Burden?

Leverage is where traders often get both excited and nervous, and for good reason.

With gold futures, you can control a large position with just a fraction of the full contract value. For example, with a small margin deposit, you might be managing exposure to gold worth $200,000 or more.

Sounds great when the market moves your way – but brutal when it doesn’t.

That same leverage that multiplies your profits can just as easily magnify your losses.

Spot gold (especially through CFDs or brokers) also offers leverage, but it’s usually more flexible and often tailored for smaller accounts.

The key difference is how risk is managed:

- In spot gold, your broker defines the leverage and margin rules.

- In futures, the exchange sets strict requirements, and margin calls are automatic if your account balance drops too low.

Leverage is like nitro in a race car – thrilling, powerful, but best handled with experience.

11. How Global Events Move Both Markets

Gold reacts to global emotions – fear, uncertainty, inflation, interest rates, and even geopolitical tension.

When big news hits – say a sudden rate cut or an unexpected conflict – both spot and futures prices light up almost instantly.

But the reaction can differ in tone and timing.

- Spot gold moves first, reflecting the immediate sentiment.

- Futures follow closely but may price in what traders think the situation means for the months ahead.

That’s why you’ll often see short-term spikes in spot gold, followed by gradual adjustments in futures contracts as the dust settles.

In essence, spot tells you what’s happening now, and futures tell you what traders believe comes next.

Together, they give a complete picture of gold’s place in the world economy – both its current pulse and its potential path.

12. Spot vs Futures: Which Fits Your Trading Style?

This is the question every trader eventually faces.

There’s no one-size-fits-all answer, but here’s a simple way to think about it:

| If you are… | Spot Gold Might Be Better If… | Gold Futures Might Be Better If… |

| A retail or beginner trader | You want simplicity and low barriers to entry | You’re comfortable with margin calls and contract expiries |

| A short-term speculator | You react to daily or hourly price movements | You prefer structured trades and larger time frames |

| A hedger or institutional player | You want to track live market prices | You need to lock in prices for future delivery or hedge exposure |

| A swing or position trader | You prefer flexibility | You thrive in disciplined, high-liquidity environments |

If you enjoy fast, flexible, short-term trading, spot gold feels more natural.

But if you like precision, structure, and long-term strategy, futures will probably speak your language.

Think of it this way:

Spot gold is like driving an automatic – smooth, responsive, and easy to control.

Futures are like driving a manual – more work, but more control once you master it.

13. Common Mistakes Traders Make

Even experienced traders can stumble when moving between the two markets.

Here are a few traps to watch out for:

- Ignoring rollover dates (for futures) – Contracts expire, and if you don’t close or roll them over, you could face unwanted settlement or margin calls.

- Overusing leverage – Both spot and futures offer leverage, but it can be a double-edged sword. Always size your trades based on risk, not temptation.

- Mixing up prices – Spot gold and futures can have slightly different prices; don’t base trades on one when you mean the other.

- Forgetting costs – Storage, spreads, and rollover fees can eat into profits if you’re not paying attention.

- Trading without context – Gold doesn’t move in a vacuum. It reacts to the dollar, interest rates, inflation, and global events. Always keep one eye on the bigger picture.

Smart traders don’t just chase prices – they understand the ecosystem gold lives in.

14. How to Read Gold Quotes (Like a Pro)

Whether you’re looking at spot or futures, knowing how to read gold quotes can save you from confusion.

Let’s decode what you might see on a trading screen:

- Spot Gold (XAU/USD): This shows the current value of gold in U.S. dollars per ounce.

Example: XAU/USD = 2350.25 means gold is trading at $2,350.25 per ounce. - Gold Futures (COMEX GC): You’ll see something like GC Jun25 – 2368.40 (+0.45%)

This means the June 2025 gold futures contract is priced at $2,368.40 per ounce, up 0.45% on the day.

Pay attention to the contract month – each one represents a future delivery period.

The closer the month, the closer the price usually is to spot.

Learning to interpret both quotes side by side helps you understand where traders think gold is headed.

15. Factors That Impact Both Markets

Gold is sensitive – maybe more than any other major asset.

Here are the main forces that move both spot and futures prices:

- Inflation and Interest Rates – When inflation rises or central banks cut rates, gold often strengthens.

- U.S. Dollar Strength – Gold and the dollar tend to move in opposite directions.

- Geopolitical Events – Wars, elections, sanctions – uncertainty always fuels demand for safe-haven assets like gold.

- Central Bank Activity – Massive gold purchases or sales by central banks can shift global sentiment.

- Market Liquidity and Risk Appetite – In risk-off environments, traders flock to gold; in risk-on phases, they may move to stocks or crypto.

Spot gold responds instantly to these shifts, while futures often price in expectations of what these events mean for the months ahead.

16. Choosing Between Gold Futures and Spot Gold

Now that we’ve broken down both markets, the real question is – which one actually suits you?

Well, it depends on what kind of trader you are.

If you like being in the moment – reacting to price swings, watching gold tick up or down, and making quick decisions – spot gold is probably your comfort zone. It’s flexible, straightforward, and doesn’t come with expiry dates or complex contract rules.

But if you prefer structure – the kind where trades are planned ahead, risks are defined, and you like the idea of locking in a price for the future – then gold futures might be a better fit.

Here’s an easy way to think about it:

- Spot gold is the trader’s version of “now.”

- Futures are the trader’s version of “what’s next.”

Many seasoned traders actually use both. They’ll trade spot for short-term moves while keeping futures positions to manage long-term exposure. It’s like balancing what’s happening today with what might happen tomorrow.

17. Spot Gold: The Ups and Downs

Let’s be honest – spot gold is popular for a reason. It’s simple, fast, and gives you a direct feel of how the market’s moving.

What’s Great

- You trade at the real-time price – no contracts or expiry dates.

- You can start small – it’s accessible even for retail traders.

- Perfect for short-term trading, scalping, or quick swings.

- You don’t have to worry about rolling contracts forward.

What’s Not So Great

- Spreads can widen during volatile hours.

- Some brokers charge overnight fees, which eat into profit.

- Leverage varies, and not all platforms offer the same terms.

In simple terms: spot gold gives you speed and simplicity. But it’s not always the cheapest or safest if you’re holding trades for long.

18. Gold Futures: The Pros and Cons

Gold futures, on the other hand, are like the professional playground.

What’s Good

- Tight pricing and high liquidity – especially on major exchanges like COMEX.

- You know exactly what you’re trading – no hidden costs.

- Leverage power – you can control large positions with relatively less capital.

- Great for hedging long-term exposure if you already own physical gold or trade spot.

What to Watch Out For

- They’re not beginner-friendly – you’ll need to learn about contract months, rollovers, and margin calls.

- Contract sizes are fixed, so flexibility is limited.

- Every contract has an expiry date – meaning you’ll need to roll or close before delivery.

Gold futures are serious business – they reward preparation, discipline, and patience. If you treat them casually, they’ll punish you just as fast.

19. How Some Traders Mix Both

Here’s something most beginners don’t realize – many smart traders combine both spot and futures gold to get the best of both worlds.

For instance:

- They might buy spot gold to ride short-term moves.

- Meanwhile, they sell gold futures to protect themselves from downside risk over the next few months.

It’s a way of keeping your exposure balanced. You stay active in the market without being overexposed to sudden swings.

Even individual traders can do this on a smaller scale – watch futures data to sense market sentiment, then trade spot when you see strong momentum.

It’s not just trading gold; it’s understanding how the market breathes.

20. How to Get Started Trading Gold

If you’re just getting into gold trading, don’t rush it. The good news? You don’t need a big account or fancy setup.

Here’s a simple, no-nonsense approach:

- Decide your path – spot or futures (start with one).

- Pick a reliable broker – look for clear fees, fast execution, and real reviews.

- Understand your leverage – know how much you’re risking for every move.

- Start small – trade tiny lots to learn the rhythm before scaling up.

- Follow global news – gold reacts to inflation data, interest rates, and even political tensions.

- Always plan your exits – it’s not about entering perfectly; it’s about managing your way out smartly.

Trading gold is like learning a musical instrument – it takes rhythm, practice, and patience. The more you trade, the better you understand its mood swings.

21. The Emotional Side of Gold Trading

Gold is emotional. Always has been.

People have trusted it for centuries – through wars, crashes, and recessions. That emotional pull still drives prices today.

When markets panic, investors run to gold. When the world feels stable, they pull back.

So if you really want to trade gold well, learn to read emotion as much as you read charts.

It’s not just price movement – it’s human behavior written in numbers.

21. The Final Word: Spot vs Futures

At the end of the day, there’s no “better” market – just different paths leading to the same metal.

- If you crave freedom and flexibility, go with spot gold.

- If you like structure and strategic control, futures might feel more natural.

Both are tied to the same asset – they just serve different personalities.

Choose the one that matches you – your risk tolerance, your trading style, your mindset.

Because in gold trading, self-awareness is worth more than any signal.

23. Closing Thoughts

Gold has this strange ability to feel ancient and modern at the same time. It’s been around forever, yet it still reacts to every tweet, every central bank comment, every rate cut.

That’s why traders love it. It’s alive.

So whether you’re trading spot gold for the rush of the moment, or futures for long-term positioning, remember – it’s not about predicting gold’s next move. It’s about understanding how it moves… and knowing when to step aside when it doesn’t make sense.

Trade smart, stay patient, and keep learning.

Because in the long run, gold always rewards those who respect its rhythm.