If there’s one market that always grabs attention – whether you’re a total beginner or someone who’s been around the charts for years – it’s gold. Something about trading gold just feels timeless. Maybe it’s the history, maybe it’s the volatility, or maybe it’s the fact that gold reacts so clearly to global events.

Whatever it is, gold isn’t just another commodity.

It’s a story that never stops unfolding… and traders love it.

So if you’ve been wondering how to trade gold effectively, how the gold commodity market works, or even how to read gold charts without feeling overwhelmed, you’re in the right place. Let’s walk through everything step-by-step, in a simple, warm, and friendly way.

1. First Things First: Why Trade Gold?

Before learning how to trade gold, it helps to understand why it’s such a popular market.

Gold is:

- A safe-haven asset – traders rush to it when markets feel unstable

- Highly liquid – meaning your trades fill smoothly

- Well-suited for day traders, swing traders, and investors

- Driven by news you actually understand (inflation, rates, USD strength, geopolitical tension)

Gold gives you both stability and volatility – two things traders appreciate.

2. How Is Gold Traded in the Commodity Market?

You don’t have to walk into a vault or buy physical bars. Today, gold is traded through multiple accessible formats, depending on your preference:

1. Spot Gold (XAUUSD)

The most popular way traders participate.

You trade gold against the U.S. dollar, just like a currency pair.

- Great for short-term trading

- No expiry

- Tight spreads

- Easy chart structure

Most CFD platforms offer spot gold, which is where most retail traders start.

2. Gold Futures (COMEX GC, MGC)

If you prefer exchange-traded products, futures are ideal.

- Standard GC contract (~100 ounces)

- Mini MGC contract (more beginner-friendly)

- Highly liquid

- Strong institutional presence

This is where professional commodity traders typically operate.

3. Gold ETFs (like GLD)

More suitable if you’re “investing” rather than trading actively.

4. Gold Mining Stocks

You’re not trading gold directly – but mining equities tend to follow gold prices.

5. Gold CFDs

This is popular with retail traders because you can:

- Trade small lot sizes

- Go long or short instantly

- Use leverage responsibly

If your goal is active day trading or swing trading, CFDs or spot gold are usually the smoothest options.

3. How to Read Gold Trading Charts (Without Overthinking It)

Gold has its own personality. Once you understand how it behaves on the chart, everything becomes easier.

Here’s what matters most:

Trend Structure

Gold trends nicely.

Uptrends and downtrends form clean swing highs and swing lows.

Ask yourself:

- Are we making higher highs and higher lows? → Uptrend

- Are we making lower highs and lower lows? → Downtrend

This alone keeps you from fighting momentum.

Key Levels

Gold respects:

- Major support and resistance

- Round numbers (like $2,000, $2,050, $1,900)

- Previous day high/low

- Weekly levels

Mark these on your chart – they act like magnets for price.

Moving Averages

You don’t need 10 indicators.

Just two moving averages are more than enough:

- 50-period EMA (short-to-mid trend)

- 200-period EMA (long-term trend)

Gold reacts beautifully to these dynamic zones.

Volume & Sessions

Gold is most active during:

- London session

- U.S. session

- Major news releases

Volatility often increases when sessions overlap.

Gold Loves News

If there’s one thing you should track, it’s:

- CPI (inflation)

- FOMC meetings

- Interest rate decisions

- Nonfarm payrolls

- USD index (DXY)

When these events drop, gold often makes sharp, tradable moves.

4. How to Trade Gold (Effective Strategies That Work)

Here are simple, high-probability ways to trade gold – without complicated theories or dozens of indicators.

Here’s the simple truth:

Global markets are connected by news, sentiment, interest rates, earnings cycles, and capital flow.

So naturally, some markets tend to mirror each other.

1. S&P 500 ↔ Nasdaq 100

Correlation: Very High (+0.85 to +0.95)

Why?

Both represent large U.S. stocks, and mega-cap tech influences both.

2. S&P 500 ↔ Dow Jones

Correlation: High (+0.80 to +0.90)

Why?

Both track U.S. large-cap companies, just weighted differently.

3. S&P 500 ↔ DAX (Germany)

Correlation: Moderately High (+0.65 to +0.85)

Why?

Germany’s economy is export-heavy and sensitive to U.S. corporate performance.

4. Nasdaq 100 ↔ Nikkei 225 (Japan)

Correlation: Moderate (+0.50 to +0.70)

Why?

Japan has a big technology sector, making it responsive to U.S. tech moves.

5. FTSE 100 ↔ S&P 500

Correlation: Lower (+0.40 to +0.60)

Why?

FTSE is heavily influenced by commodities and the British pound – different drivers.

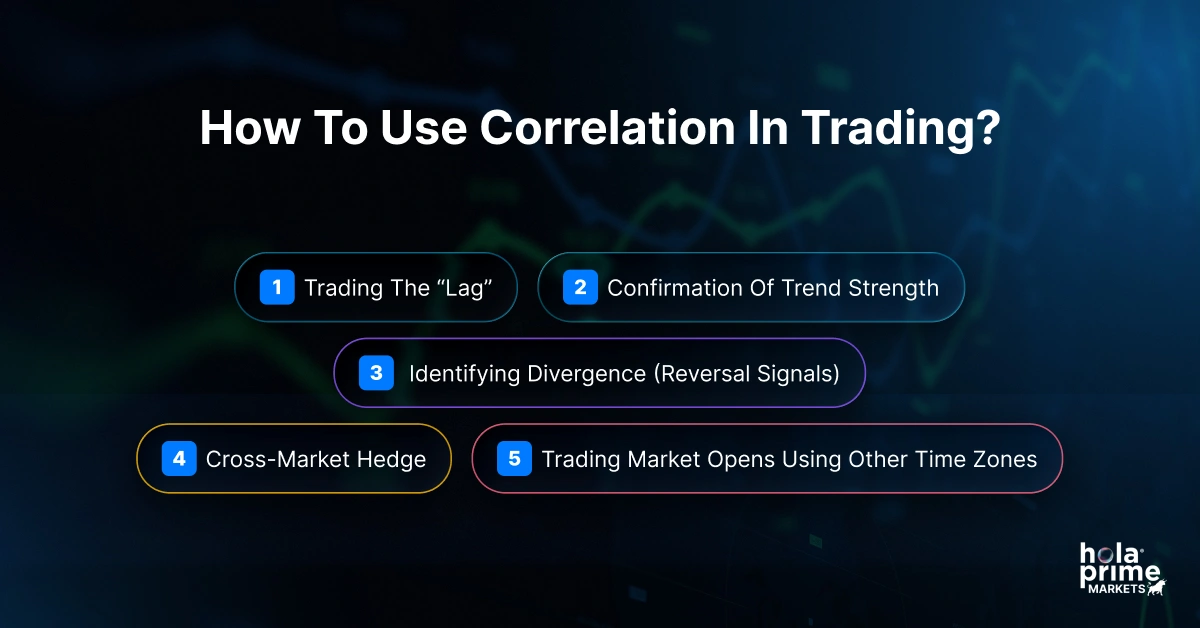

4. Where Correlation Creates Trading Opportunities

Correlation isn’t just a fun statistic – it’s practical.

Here’s how to turn it into strategy.

Strategy 1: Trend Continuation Using Pullbacks

Gold trends often last much longer than expected.

How it works:

- Identify the trend using price structure

- Wait for a pullback into a support zone

- Confirm with a candle pattern

- Enter with the trend

Works especially well around:

- 50 EMA

- Demand zones

- Previous breakout levels

This is the most popular strategy among swing traders.

Strategy 2: Breakout Trading Around Key Levels

Gold breaks levels aggressively – and when it does, the move usually continues.

Breakouts work best when:

- Price consolidates tightly

- Major news is approaching

- Volume builds

- The level is clean and obvious

Just avoid chasing breakouts during thin volume.

Strategy 3: Range Trading (Gold Does This More Often Than You Think)

Gold spends a lot of time forming horizontal ranges between clear support and resistance.

You simply:

- Buy near support

- Sell near resistance

- Keep stops tight

- Take partial profits quickly

Perfect for intraday trading.

Strategy 4: News Reaction Scalping

Gold loves reacting to:

- CPI

- FOMC

- NFP

- Fed speeches

The trick is not predicting the number, but trading the reaction.

You wait for:

- Initial spike

- Pullback

- Directional continuation

This takes practice but can be extremely rewarding.

5. How to Invest in Gold (If You Prefer Longer-Term Positions)

Day trading not your style? No problem.

Long-term gold investing options include:

1. ETFs like GLD

Simple, liquid, and regulated.

2. Physical gold (less common but still an option)

Bars, coins, bullion.

3. Gold futures (for long-term positions with leverage)

Institutions often use this approach.

4. Gold-related stocks

Mining companies and ETFs like GDX.

When investing in gold long-term, focus on:

- Interest rate cycles

- Dollar trends

- Recession fears

- Inflation cycles

- Central bank buying

Gold shines brightest during economic uncertainty.

6. Risk Management (Where Most Gold Traders Go Wrong)

Gold rewards discipline, but it punishes recklessness fast.

Here’s how to stay safe:

- Use stop losses every time

- Risk 1–2% per trade max

- Avoid oversized positions during news

- Don’t revenge trade (gold moves can be emotional)

- Use leverage responsibly

- Let trades play out – gold wicks can be dramatic

A steady, calm approach works best with this instrument.

Final Thoughts: Gold Is a Market You Can Master

You now know:

- How gold is traded

- How to read gold charts

- How to trade gold effectively

- Which strategies work best

- How to invest long-term

Gold is one of the most beginner-friendly and opportunity-rich commodities on the planet. It respects structure, reacts to fundamentals, and offers clean setups almost every week.

And the best part?

You don’t need a huge account, a fancy setup, or dozens of indicators.

Just good discipline, clear levels, and a solid understanding of how the market moves.