When traders talk about “the markets,” they’re usually talking about one of two big U.S. indices that shape most of the action every day: the Nasdaq 100 and the Dow Jones Industrial Average.

Both are iconic.

Both influence global markets.

Both offer amazing trading opportunities.

But they behave very differently – almost like two athletes with completely different personalities.

If you’ve ever wondered:

- Should I trade the Nasdaq or the Dow?

- Which one actually fits my style?

- Are they really that different?

Then you’re about to get the clearest, most human breakdown you’ll ever read.

Let’s make this super simple.

1. The Nasdaq 100: The Fast, Tech-Driven Sprinter

If the Nasdaq 100 were a person, it’d be that friend who runs on caffeine, loves innovation, and can’t sit still for five minutes.

It’s fast.

It’s emotional.

And it reacts instantly to anything related to tech or growth.

Why?

Because the Nasdaq 100 is made up of the 100 biggest non-financial companies, and nearly 50%+ of its weight comes from tech giants like:

- Apple

- Microsoft

- Amazon

- NVIDIA

- Google

- Tesla

- Meta

When these giants sneeze, the Nasdaq catches a cold.

How it behaves on the charts:

- Big swings

- Rapid trends

- Strong reactions to news

- High volatility (which traders love)

- Beautiful momentum during tech rallies

If you enjoy fast markets with clear direction and strong intraday setups, the Nasdaq feels like home.

2. The Dow Jones: The Steady, Old-School Heavyweight

Now imagine the Dow as an older, disciplined athlete – reliable, predictable, and focused on consistency rather than speed.

It only includes 30 companies, but these companies are traditionally:

- blue-chip

- stable

- established

- industry leaders

Think Coca-Cola, McDonald’s, Johnson & Johnson, Boeing, Walmart, Home Depot, Visa, and so on.

This index represents the “old guard” of American business.

How the Dow behaves on the charts:

- Slower and steadier than the Nasdaq

- Smaller intraday swings

- Responds more to economic or industrial news

- Less sensitive to tech-specific catalysts

- Ideal for methodical, patient traders

The Dow is the place where traders go when they want structure rather than chaos.

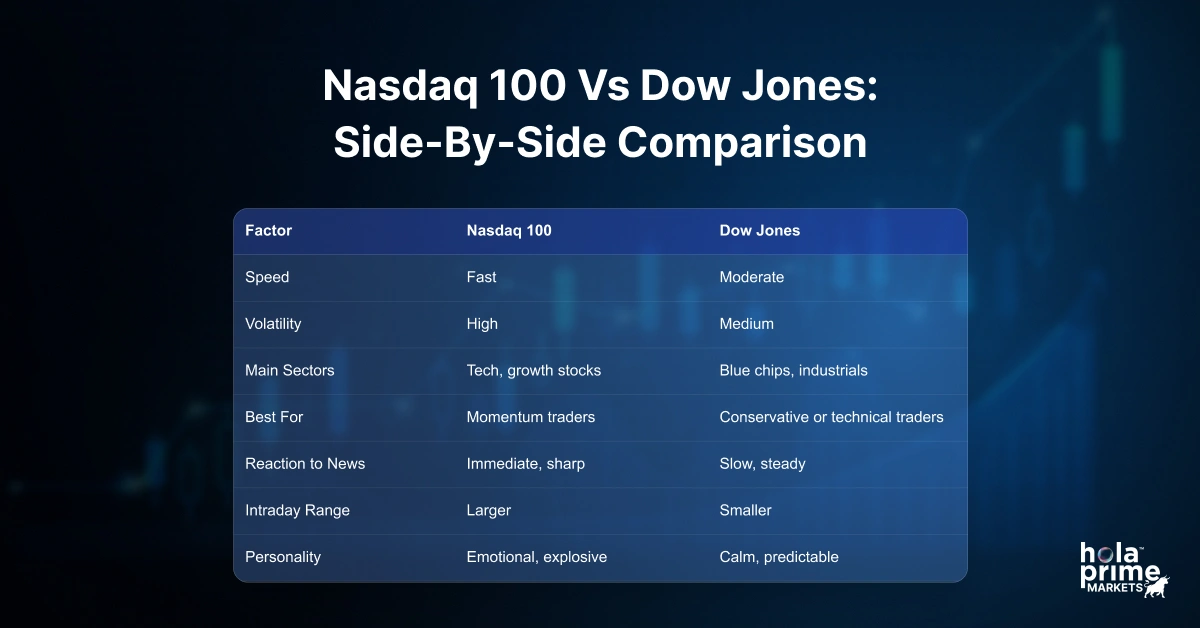

3. Nasdaq 100 vs Dow Jones: Side-by-Side Comparison

Let’s compare them the way traders actually care about – not the textbook difference, but the practical one.

If you love fast markets → Nasdaq 100

If you prefer stability → Dow Jones

It really is that simple.

4. Which One Should YOU Trade?

Trading style is personal.

Some traders thrive in chaos; others need structure.

Here’s a quick way to figure out which index aligns with you.

You’ll probably love the Nasdaq 100 if…

- You enjoy momentum

- You like catching breakouts or breakdowns

- You’re comfortable with volatility

- You react fast

- You like tech stocks

- You prefer wider ranges for better risk-reward

Nasdaq traders tend to be the people who enjoy energy, speed, and active markets.

You might prefer the Dow Jones if…

- You want slower, more predictable moves

- You prefer mean-reversion or fade setups

- You don’t like sudden spikes

- You’re more analytical than instinctive

- You trade with bigger size and need stability

- You enjoy steady trends or sideways structure

Dow traders typically value patience, structure, and clean technical levels.

5. News Events Affect Them Differently

Both indices react to economic news, but in totally different ways.

Big tech news → Nasdaq goes wild

- Apple earnings

- AI announcements

- Cloud growth

- Semiconductor updates

Macro or economic news → Dow responds more

- Interest rate changes

- Industrial data

- Consumer spending

- Manufacturing numbers

If you’re someone who trades around news, pick the index that aligns with how you handle volatility.

6. Which One Is Better for Beginners?

It depends on the person – but generally:

Dow Jones = safer for beginners

- smoother intraday action

- fewer sudden reversals

- slower pace

Nasdaq 100 = better for fast learners

- more opportunities

- bigger moves

- steeper learning curve

Think of it like driving:

- Dow = steady city traffic

- Nasdaq = a racetrack

Both can be fun… if you know what you’re doing.

7. Which One Is More Profitable?

Here’s the truth:

Neither is automatically “more profitable.”

It depends on the trader.

But each offers unique advantages:

Nasdaq 100 profit potential:

- larger moves = bigger opportunity

- more momentum = more setups

- ideal for scalping and day trading

Dow Jones profit potential:

- precise levels = cleaner technical setups

- less whipsaw = easier stop placement

- perfect for swing or intraday fade strategies

Both indices can pay you well – if you stick to the one that matches your strengths.

8. Final Verdict: Nasdaq 100 vs Dow Jones

Trade the Nasdaq 100 if you like…

- Speed

- Momentum

- Volatility

- strong trends

- modern tech-focused markets

Trade the Dow Jones if you like…

- Stability

- Structure

- smoother charts

- slower intraday moves

- classic blue-chip behavior

No index is “better.”

There’s only better for YOU.

Some traders even use both:

- They scalp the Nasdaq during high-volatility windows

- They swing the Dow during calmer markets

It’s not about loyalty – it’s about opportunity.