If you spend even a week around futures traders, you’ll notice something quickly: everyone has their favorite market.

Some swear by the indices – the adrenaline-filled micro-movements of the S&P 500, the raw personality of the NASDAQ, or the steady grind of the Dow.

Others only want commodities – the tangible stuff like gold, corn, soybeans, and wheat.

And then there are the energy traders… the ones addicted to the fast, wild, sometimes chaotic behavior of crude oil and natural gas.

But here’s the thing:

Most new traders jump straight into futures without understanding which markets are out there, how they differ, and why each one behaves the way it does.

The futures world isn’t one giant pool – it’s a collection of unique ecosystems, each with its own rhythm, catalysts, trading times, liquidity cycles, and opportunity profiles.

So in this article, we’ll break down the three biggest pillars of the futures market:

-

Index Futures

-

Commodity Futures

-

Energy Futures

And more importantly, which type of trader each one suits.

Let’s dive in.

1. Index Futures

Index futures are the backbone of modern futures trading. They represent the broad movement of stock markets and because millions of traders watch them, they’re extremely liquid.

The big ones you’ll hear about daily:

E-mini S&P 500 (ES) & Micro E-mini (MES)

This is the king of futures.

If futures had a Times Square, ES would be the center.

Why traders love it:

- Smooth price movement

- Excellent liquidity

- Responds cleanly to economic data

- Tight spreads

- Ideal for day trading & scalping

NASDAQ (NQ / MNQ)

Hyperactive.

Twitchy.

Unpredictable.

NQ is the “wild child” of indices and that’s exactly why traders chase it.

It moves fast, trends hard, and can reverse without warning.

Why traders love/hate it:

- Incredible volatility = huge opportunity

- But also requires strict discipline

- Best for momentum traders

Dow Jones (YM / MYM)

Steadier, slower, cleaner.

YM gives you index behavior without the crazy speed of NASDAQ.

Why Index Futures Matter

Index futures are tied to:

- Big economic announcements

- Earnings seasons

- Federal Reserve decisions

- Risk sentiment (fear vs greed)

If you love trading macro, interpreting news, or analyzing market psychology, index futures are your arena.

Best for:

- Day traders

- News traders

- Scalpers

- Traders who love rhythm & flow

2. Commodity Futures:

Commodity futures are where traders touch the physical world – crops, metals, consumables, things we produce and use every day.

These markets behave differently from indices because their supply and demand stories are more “real world” than “macro financial.”

Agricultural Futures

Examples:

- Corn (ZC)

- Wheat (ZW)

- Soybeans (ZS)

These markets move based on:

- Weather conditions

- Harvest forecasts

- Seasonal patterns

- Crop reports (like WASDE)

Ag markets have extremely predictable seasonal cycles – a huge advantage for traders who love structure.

Metals Futures

Examples:

- Gold (GC / MGC)

- Silver (SI)

- Copper (HG)

Gold doesn’t just move because of supply and demand – it moves because of fear, inflation, and interest rates.

Silver tracks gold, but with more volatility.

Copper is tied to construction and industry, so it reacts to China’s economic activity.

Why Commodity Futures Matter

Commodity futures are ideal for traders who prefer markets influenced by:

- Seasonality

- Physical supply chain dynamics

- Long-term macroeconomic trends

They’re often less chaotic than oil or NASDAQ, making them great for swing trading.

Best for:

- Swing traders

- Macro traders

- Fundamental analysts

- Traders who prefer structured seasonal trends

3. Energy Futures:

If index futures are predictable and commodities are seasonal, energy futures are… pure chaos.

Beautiful chaos, but still chaos.

The main ones:

Crude Oil (CL / MCL)

The king of volatility.

CL reacts to:

- OPEC meetings

- Geopolitical tensions

- Inventory reports (EIA)

- Global economic outlook

- Supply disruptions

An oil trader needs:

- Fast reflexes

- Strong risk control

- Emotional neutrality

Get those, and oil can be the most profitable market in futures.

Natural Gas (NG)

Nicknamed:

- “The Widowmaker”

- “The Beast”

- “The Monster”

And for good reason.

Natural gas can move 5–10% in a day on weather forecasts alone.

Think twice before trading NG without experience.

Why Energy Futures Matter

Energy futures offer:

- Massive moves

- Great intraday opportunities

- Large trend days

- Powerful reactions to news

They’re not for beginners – but for experienced traders, they’re unmatched.

Best for:

- Momentum traders

- Volatility traders

- Experienced scalpers

- Traders who stay calm under stress

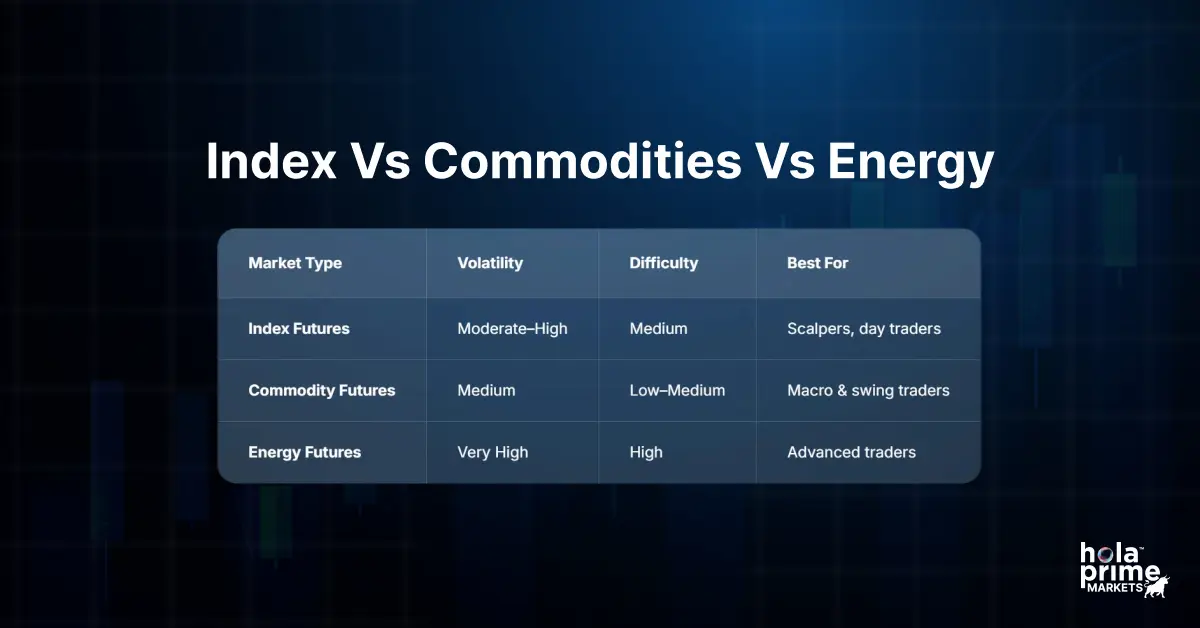

Index vs Commodities vs Energy: Which Should You Trade?

Here’s a quick comparison to help you choose:

Final Thoughts: The “Best” Futures Market Depends on YOU

There is no universally perfect futures market.

Each one rewards a different personality, risk tolerance, and trading style.

But here’s the simple rule:

Trade the market that matches your temperament.

If you love speed – NASDAQ or Oil

If you like structure – Gold or Corn

If you want consistency – S&P 500

If you want extremes – Natural Gas

The great thing about futures is that they give you options – endless options – and each market tells a different story.

Master one, and you can build a lifelong trading career.