Introduction

There’s a moment in everyone’s financial journey where a simple question appears: “How do people actually make money trading currencies?”

Maybe you saw someone talk about EUR/USD on YouTube. Maybe a friend mentioned forex over coffee. Or maybe you’re genuinely curious about financial markets and want something beyond traditional investing.

Whatever brought you here, you’re now in a good place – because in this guide, we’re going to break down forex trading in a way that actually feels human, useful, and real. No intimidating jargon without explanation. No hype. Just clarity.

Let’s start at ground level and build up from there.

Why Forex Suddenly Feels Like a Big Deal

For a long time, forex was a world reserved for banks, governments, and financial experts sitting in trading floors filled with glowing screens. Then came the internet, trading platforms, smartphones, and global access. Now, someone sitting at home can participate in the same market that central banks play in.

That thought alone feels empowering and terrifying at the same time, doesn’t it?

Forex is popular today because it offers something rare: a skill that isn’t limited by your background, location, or degree. If you learn it, you can use it for a lifetime. If you ignore it, you’ll still feel its effects because currencies shape everything – from fuel prices to the cost of a coffee in another country.

But let’s pause the poetry and get to the basics.

So… What Is Forex Trading?

Forex trading, in the most human-friendly sentence possible, is simply the act of buying one currency while selling another at the same time, trying to profit from the change in their value.

If you have ever travelled internationally and exchanged money at an airport counter, congratulations – you have already participated in forex.

Let’s say you went from India to Europe and exchanged INR for EUR. If the value of the euro rose before you came back and you exchanged your euros back to rupees, you’d end up with more money than you started with. That profit happened because currencies move in price constantly.

In trading, you don’t physically travel or hold cash. You do it digitally through a broker.

That’s forex trading in essence: predicting whether one currency will get stronger or weaker against another.

“Forex” vs “FX” – Same Idea, Same Market

People use the two words interchangeably. Forex means foreign exchange. FX is just a short slang version. Both refer to the global marketplace where currencies are traded.

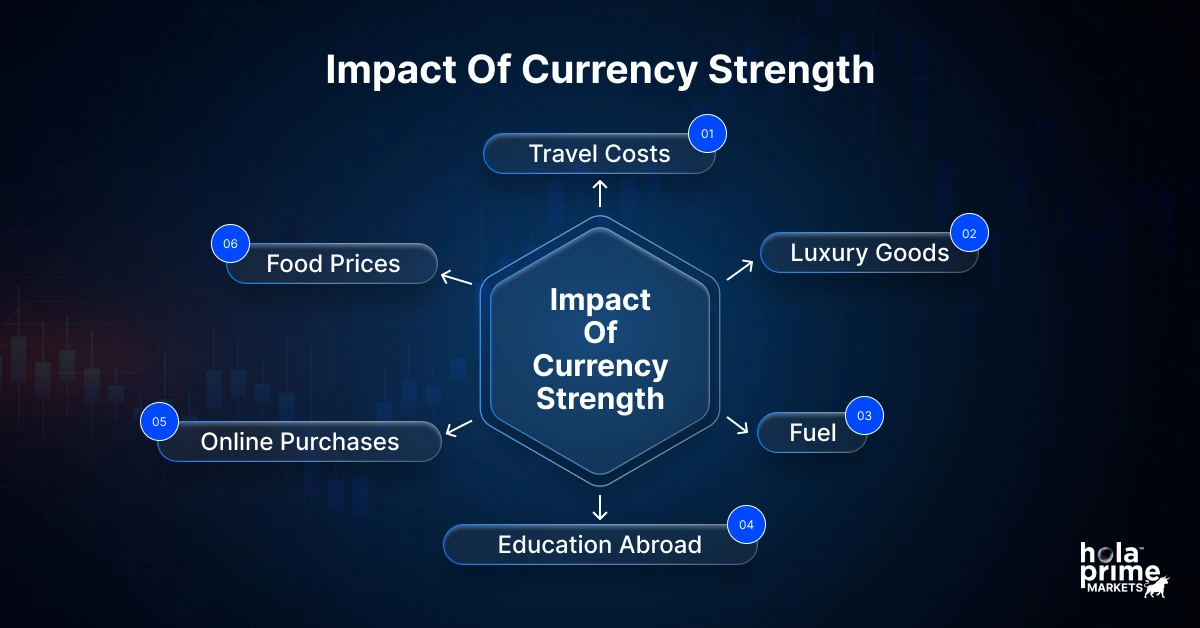

Why Currency Strength Even Matters

Currencies are living things. They breathe, they weaken, they strengthen, they react to global events. When a country’s economy is strong, its currency often strengthens. When a nation is struggling, its currency often weakens.

This affects everyday life more than most people realize:

Food prices

Travel costs

Luxury goods

Fuel

Education abroad

Online purchases

If your local currency weakens significantly, your cost of living rises. When a nation’s currency is strong, it imports goods cheaply and has better financial stability.

Forex isn’t just a market – it’s the invisible engine behind the global economy.

The Forex Market Isn’t New – It Just Became Accessible

Before the internet, forex trading was mostly done by banks, governments, and corporations. In 1971, the modern foreign exchange system truly began when currencies stopped being tied to gold and started floating freely based on demand.

Fast forward to today – technology flipped the tables. Everyone with a laptop or phone can participate. The difference between those who thrive and those who struggle comes down to education and discipline.

Who Trades in the Forex Market?

The forex world is a mix of giants and everyday individuals. At the top are central banks, big commercial banks, hedge funds, and multinational corporations. They move billions because they need to manage national monetary policies, corporate finances, or large investments.

Then you have individual traders – people like you and me. Retail traders don’t move the market, but we participate in it and ride the waves the big players create.

What Makes Forex Different From Stocks?

Stocks represent ownership in a company. Forex doesn’t give ownership – it’s about exchanging value between nations. You aren’t betting on a CEO or a quarterly earnings report. You’re reading economic health, interest rates, global events, and sentiment.

Forex operates twenty-four hours a day, five days a week. You can trade almost anytime, unlike stocks. And forex is massive – trillions move daily. That liquidity makes entering and exiting trades smoother.

But one of the biggest differences is leverage – and this is where beginners must be carefully.

The Concept of Leverage: Double-Edged Sword

Leverage in forex allows you to control a much larger position than your deposit. If your broker offers leverage, you might control a $10,000 trade with $100. Sounds powerful, right? It can be. It can also be destructive if misused.

Leverage amplifies gains, but it also amplifies losses. A beginner often loves leverage until they realize it can wipe an account faster than it grows.

Every experienced trader shares one lesson: respect leverage, or the market teaches you the hard way.

Understanding Currency Pairs

You always trade currencies in pairs because you’re comparing one against another. Think of them as two players in a tug-of-war.

EUR/USD

GBP/JPY

USD/JPY

The first currency in the pair is the base currency. The second is the quote currency. If EUR/USD is 1.1000, it simply means one euro equals 1.10 dollars.

When you click “buy” on EUR/USD, you’re betting the euro strengthens against the dollar. When you click “sell”, you believe the euro will weaken and the dollar will strengthen.What Moves Currency Prices?

Currencies rise or fall based on supply and demand. But what affects the supply and demand? Here are the main drivers in plain language:

Economic strength

Interest rate decisions by central banks

Inflation and employment data

Geopolitical events

Market sentiment and global risk appetite

Unexpected news or crises

A major speech by a central bank head can shift markets in seconds. A war can cause currencies to swing violently. A positive GDP report can strengthen a currency overnight.

Trading forex is less about guessing and more about learning how the world reacts to information.

The Tools and Terms Traders Must Know

You’ll often hear terms like pip, lot, spread, margin, and slippage. They sound complex until you understand them. For example:

A pip is simply a tiny unit of measurement in market movement.

A lot is the size of your trade.

Spread is the difference between the buy and sell prices.

Margin is the amount of money set aside to hold a trade open.

Slippage is when you don’t get the exact price you wanted in fast-moving markets.

These aren’t barriers – they’re just vocabulary. Learning them is like learning chess pieces before learning strategy.

How People Actually Trade Forex

Different people trade in different ways:

Some hold trades for minutes and scalp fast moves.

Some day trade, opening and closing positions within hours.

Some swing trade, holding positions for days.

Some position trade, riding long-term economic cycles.

There isn’t a right or wrong style. There is only the style that fits your personality, schedule, and risk tolerance.

Trading is not about copying others. It’s personal.

The Emotional Side No One Talks About Enough

Markets don’t only test your intelligence. They test your emotions. Fear and greed are the silent enemies. Many traders lose money not because they don’t understand charts, but because they don’t control impulses.

Over-trading

Chasing losses

Getting overconfident

Refusing to accept small losses

This game rewards maturity, patience, and humility more than excitement or speed.

Risk Management – The Real Secret of Successful Traders

Professional traders obsess over risk, not profits. They know profit is a by-product of controlled decisions. They always have a plan. They decide how much of their account they risk on each trade. They use stop-loss orders. They accept losses gracefully.

A good trader isn’t someone who avoids losing. A good trader is someone who never lets one loss destroy them.

Can Anyone Learn Forex?

Yes – but not everyone will succeed. Not because it’s impossible, but because many give up before learning discipline. Forex rewards those who treat it like a skill, not a lottery.

Think about it like learning music or martial arts. You don’t master it in one month. You build it, layer by layer, with practice and patience.

Is Forex Legal and Ethical?

In most countries, forex is completely legal. Regulation varies, but the activity itself is lawful.

Is it ethical? Absolutely – as long as you trade fairly, do not engage in scams, and use regulated brokers. In Islamic finance, swap-free accounts exist so trading can comply with interest-free principles.

Forex becomes unethical only when people treat it as gambling or scam others with fake signals and illusions of quick wealth. Real trading is rooted in skill, study, and strategy.

How to Begin the Right Way

Start with curiosity. Then add education. Build a foundation. Practice in a demo account. Watch charts. Learn strategies. Study risk management. Eventually, when you feel confident and consistent, move to live trading – slowly, thoughtfully, with discipline.

This market rewards patience. It punishes rush.

Closing Thought

Forex is not magic. It is not a shortcut. And it is not a get-rich scheme. It is a financial craft that requires learning, emotional control, and practice.

But if you treat it as a serious skill – one that you build step by step – it can become one of the most empowering abilities you ever develop.

Not because of the money alone, but because of the mindset growth it demands: patience, discipline, calm, strategy, and focus.

And those traits serve you far beyond trading.

If you’re curious, take the first step. If you’re serious, take the right steps. The market will always be there. Your job is simply to prepare for it the right way.